Setting The Record Straight: Big Tech Is Working For America

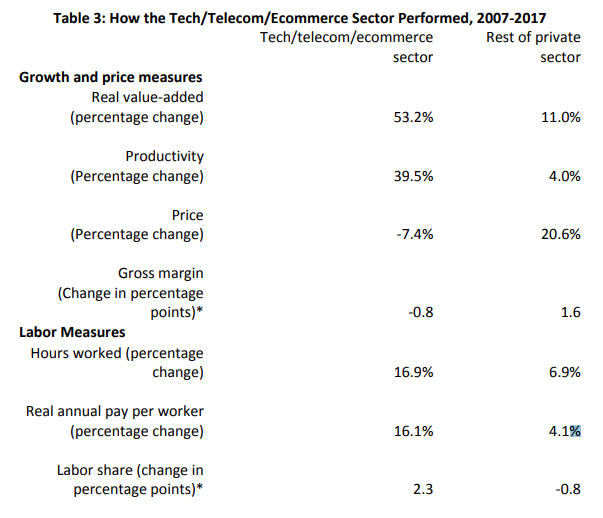

| During today’s House Antitrust Subcommittee hearing, we saw a strong defense of the American technology industry. Tech companies help consumers enjoy a vast market of free or less-expensive products that are regularly increasing in quality. Despite all the misconceptions around the industry and antitrust enforcement on display today, we know that: – Antitrust enforcement under the consumer welfare standard is working. – There is tremendous competition and innovation happening across the US tech industry. – Tech remains among the most popular industries in the country, and is making a profound impact in helping people get through the pandemic. – Big tech firms help small businesses reach new customers more efficiently. – Access to data does not serve as a barrier to entry to new competitors; studies show data has little economic value. – The advertising market is as competitive as ever, driving down prices as options expand. Antitrust enforcement under the consumer welfare standard is working. FTC Commissioner Noah Phillips underscores that antitrust legal decisions should not—and are not—used to achieve ulterior motives aside from protecting competition. “American courts have taken welfare maximization as their magnetic north, rejecting attempts to use competition law to achieve or protect ends beyond guarding the competitive process.” The current antitrust framework is built to prevent anti-competitive harm, ultimately protecting consumers, notes Danny Sokol of the University of Florida Levin College of Law. “Antitrust requires predictable and effective rules that protect consumers and promote innovation and risk taking. The current institutional design of antitrust and the development of antitrust case law promotes such an approach. This institutional design has been long-standing across both Republican and Democratic administrations. Antitrust can and will adjust to particular facts and business realities when there is anti-competitive harm.” The current antitrust framework is “up to the job” thanks to its objectivity and flexibility, highlights Joshua Wright of George Mason University. “Modern antitrust law, guided by the consumer welfare standard, is, to put it plainly, up to the job… The consumer welfare framework has the flexibility to expand and contract enforcement in response to changes in sound empirical evidence over time. Indeed, it’s done so over time, with changing technology and changing understanding of business behavior.” There is tremendous competition and innovation happening across the US tech industry. Frequent disruption in the technology sector demonstrates the benefits of competition, driving innovation and investment, argues Geoffrey Manne of the International Center for Law and Economics. “High-tech industries are often marked by frequent disruptions or paradigm shifts rather than horizontal market share contests; and spending on innovation and investment are important signals of competition, which comes from the continual threat of new entry down the road—often from competitors who, though they may start with relatively small market share, or may arise in completely different markets, can rapidly and unexpectedly come to overtake incumbents.” PPI’s Michael Mandel finds the tech sector has ‘outperformed’ the rest of the private sector, suggesting competition in the tech sector is fierce. “The TTE sector has outperformed the rest of the private sector on every macroeconomic indicator. Indeed, the evidence suggests that to the degree that there are competition problems in the US economy, they are more likely to be found outside the TTE sector.” (Michael Mandel, “Taking Competition Policy Seriously: Macro Indicators For Regulators,” FTC, 8/15/18). |

|

| “The possibilities for future competition” in tech are underestimated, argues Bret Swanson of the American Enterprise Institute. “The dominant companies of an era always look invincible at the time. Sometimes these companies remain dominant — as Thompson points out, America’s three early-20th century auto industry leaders are still the big three today. But the list of seemingly obvious monopolies that later went bankrupt is also long (and humorous). And the possibilities for future competition in the tech industry are underestimated.” Tech remains among the most popular industries in the country, and is making a profound impact in helping people get through the pandemic. Overall, the majority of Americans (62%) believe tech services have a positive impact in addressing the pandemic, third only to hospitals (73%) and health providers (69%). Additionally: – 89% of respondents believe technology services have been “very important” or “somewhat important” during the COVID-19 pandemic. – 76% believe tech has a positive impact on the US economy. – 79% have a positive view of the tech industry/ – 69% believe that technology will make their and their family’s lives better in the future. |

|

| Big tech firms help small businesses reach new customers more efficiently. Digital tools create more affordable advertising avenues for small businesses, allowing them to reinvest and provide lower prices to consumers, as supported by a Progressive Policy Institute study. “For every $3 that an advertiser currently spends on digital advertising, they would have to spend $5 on print advertising to get the same impact. To put it another way, digital ads are 40 percent cheaper than print ads of equivalent effectiveness.” The tech market is interconnected, with leading tech services enabling small businesses to access affordable and scalable resources, argues Jake Ward of the Connected Commerce Council. “When considering the role of large tech companies in the market, it is essential Members of Congress think about small businesses’ deep connection to these companies. This market is interconnected and big companies power growing companies to compete and win.” Access to data does not serve as a barrier to entry to new competitors; studies show data has little economic value. Alec Stapp, International Center for Law and Economics: Data has nearly zero marginal costs. “Data is merely encoded information (bits of 1s and 0s), so gathering, storing, and transferring it is nearly costless (though, to be clear, setting up systems for collecting and processing can be a large fixed cost). Under perfect competition, the market clearing price is equal to the marginal cost of production (hence why data is traded for free services and oil still requires cold, hard cash).” A Financial Times review of industry pricing shows that a consumer’s data has very little value. “General information about a person, such as their age, gender and location is worth a mere $0.0005 per person, or $0.50 per 1,000 people. A person who is shopping for a car, a financial product or a vacation is more valuable to companies eager to pitch those goods. Auto buyers, for instance, are worth about $0.0021 a pop, or $2.11 per 1,000 people.” Marketing scholars Anja Lambrecht and Catherine Tucker find that simply amassing data does not produce a competitive advantage. “The unstable history of digital business offers little evidence that the mere possession of big data is a sufficient protection for an incumbent against a superior product offering. To build a sustainable competitive advantage, the focus of a digital strategy should therefore be on how to use digital technologies to provide value to customers in ways that were previously impossible.” Economist David Evans: Spotify’s success proves that lack of data is not a barrier to entry for startups. “A similar story was true for Spotify. When it entered the U.S. 2011, Apple had more than 50 million iTunes users and was selling downloaded music at a rate of one billion songs every four months. It had data on those people and what they downloaded. Spotify had no users, and no data, when it started. Yet it has been able to grow to become the leading source of digital music in the world. In all these cases the entrants provided a compelling product, got users, obtained data on those users, and grew.” The advertising market is as competitive as ever, driving down prices as options expand. Digital advertising channels are poised to continue growing across all categories, creating even more space for new entrants, as noted by Erik Oster in AdWeek. “Online advertising is predicted to grow across all categories again in 2020, increasing 14.5% to $166.4 billion… Between influencer marketing and paid social, which is expected to jump 17% to $42.3 billion, social media marketing is poised to comprise nearly 25% of digital spending. Search remains the largest category, predicted to grow 11.2% to $60.9 billion.” Advertisers aren’t locked into any particular ad tech provider. In a November 2018 Advertiser Perceptions report, U.S. advertisers reported using an average of 2.8 demand-side platforms each over the past year. Publishers used an average of six sell-side platforms each, according to a 2019 Advertiser Perceptions survey. Fees are dropping in this competitive market. Ad tech fees paid by advertisers as a percentage of programmatic display ad spend are down, and are projected to continue to fall into 2021. |